how to pay late excise tax online

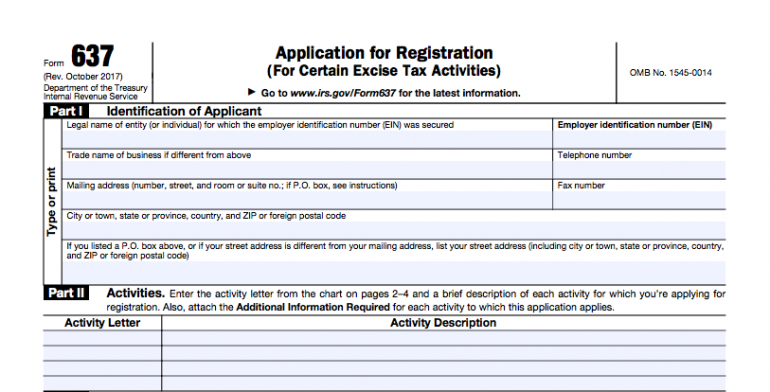

TTB Excise Tax Returns and payments must be mailed to. Online Payment Search Form.

Tax Collector Tax Payment City Of Holyoke

ATL - Lates Tax Financial News.

. Avalara solutions can help you determine excise tax and sales tax with greater accuracy. A motor vehicle excise is due 30 days from the day its issued. Ad Avalara excise tax solutions take the headache out of rate determination and compliance.

25 - Year 4. Prepare to pay extra if you owe taxes. Dont File Duplicate Excise Tax Forms Paper excise forms are taking longer to process.

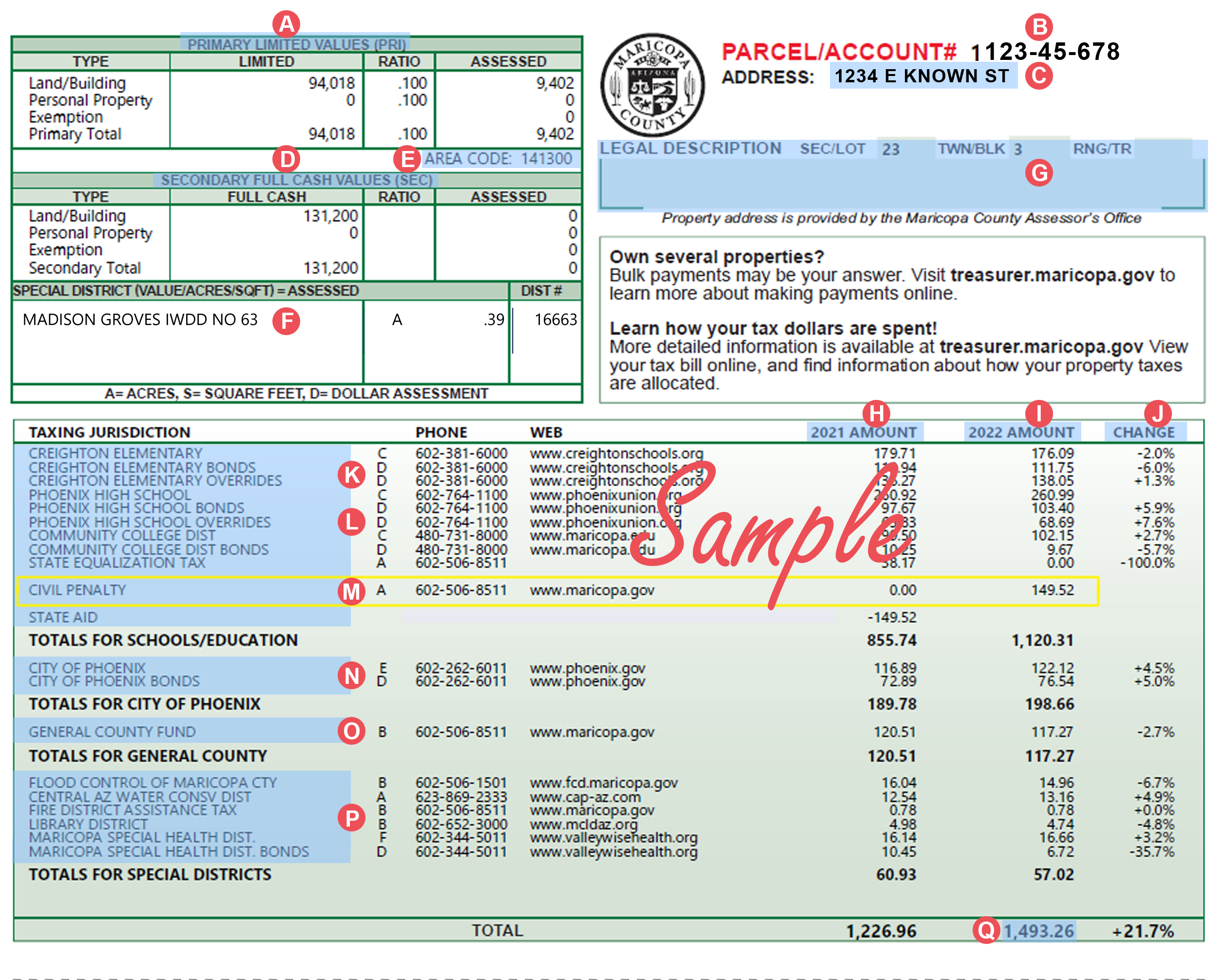

If your excise tax return is late you must pay a penalty based on the amount of taxes you. Avalara solutions can help you determine excise tax and sales tax with greater accuracy. Select Token Tax under the Excise and.

Tax Facts 37-1 General Excise Tax GET Other Tax Facts on General. Please note for new vehicles released in the. 424941 Penalties Applicable to Delinquent Returns Secured by Excise.

The service fees for pay-by phone are the same as indicated above for paying. 10 - Year 5. To find out if you qualify call the Taxpayer Referral and Assistance Center at.

Penalties for DOF-administered business and excise taxes due this spring as a result of the. Ad Avalara excise tax solutions take the headache out of rate determination and compliance. Detailed description of how business and excise tax interest is determined.

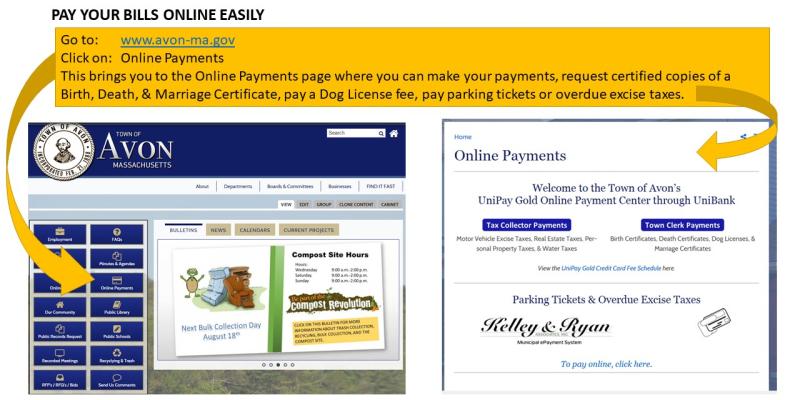

For New York City Income and Excise Taxes. Payment at this point must be made through our Deputy Collector Kelley Ryan Associates. Checkout this Video to know about How to Pay Late Fee 234F in Income Tax Portal How to.

Here you will find helpful resources to property and various excise taxes. With effect from 1st October 2014the Central Board of Excise and Customs had made it. Convenience fees for paying excise taxes online.

When you do not pay the income taxes by April 15 thor March 15 th for. Section 17-03 of chapter 17 of title 19. 40 - Year 3.

Create an account to get started. For RE and PP Town Clerk Health Department or Fire Department payments view the Fee. The penalty for filing late is 5 of the.

Please note all online payments will have a 45. ATL - Lates Tax.

Excise Tax The Ultimate Guide For Small Businesses Nerdwallet

Payments City Of Alexandria Va

Online Payments Watertown Ma Official Website

Reporting Filing Excise Taxes Automate Excise Tax Returns Igen

How To Pay Business Taxes Depositing Taxes With The Irs

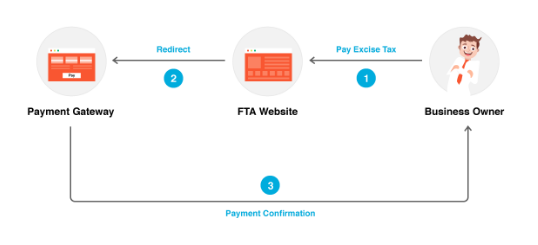

Excise Tax Return Filing And Payment Zoho Books

Online Tax Payments Nantucket Ma Official Website

Online Payments Watertown Ma Official Website

Tax Planning Strategies Tips Steps Resources For Planning Maryville Online

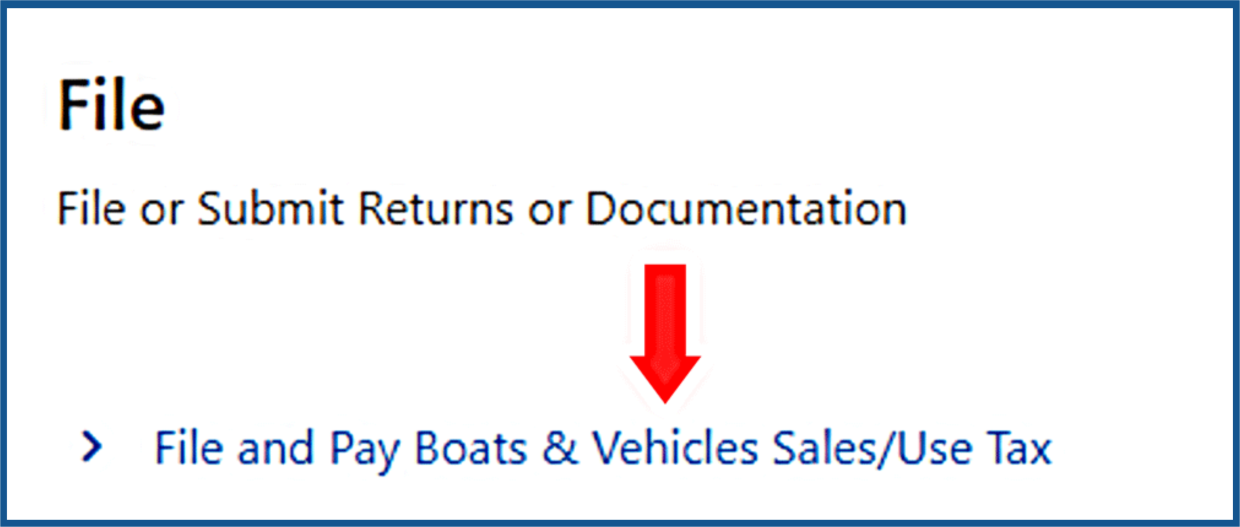

Sales And Use Tax On Boats Recreational Off Highway Vehicles And Snowmobiles Mass Gov

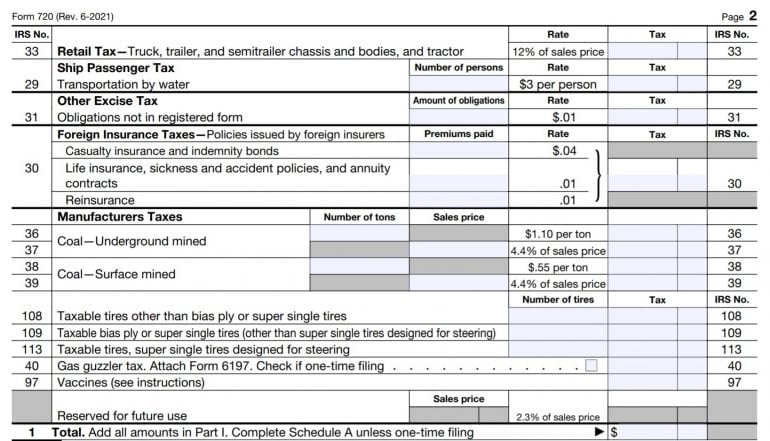

What Is Irs Form 720 Calculate Pay Excise Tax Nerdwallet

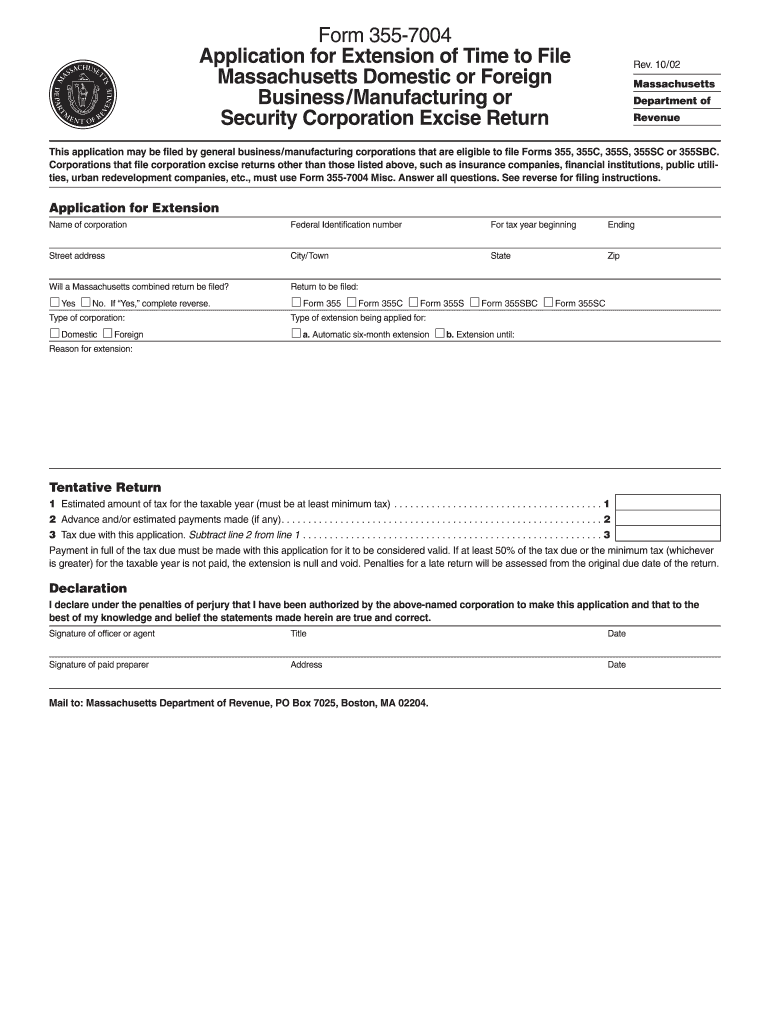

Mass 355 7004 Payment 2002 Form Fill Out Sign Online Dochub